Despite the ongoing SAG-AFTRA strike, sales agents and distributors are convening in Santa Monica this week in the hopes of reconnecting with buyers and kicking off deal discussions at the American Film Market.

After an underwhelming Toronto Film Festival, which saw little deal activity, there’s hope that a few of the starry packages being shopped at AFM will get picked up. But given the climate in Hollywood, many projects won’t officially hit the market until February at the European Film Market in Berlin.The marketplace is not only strained by the strike but the shifting appetites and belt-tightening at the major studios and streamers. At the same time, the return of buyers from China to AFM after several years away is seen as a positive sign.

“Given the strikes and the tough global climate, many of the top international sales agents and talent agencies are holding back from exposing too many new high-end packages and will probably wait for the first half of next year,” said Dylan Leiner, senior exec VP of acquisitions and production for Sony Pictures Classics. And yet, Leiner noted, “There is a resilience in the independent market because of the wide range of films coming from international territories as well as documentaries, so companies looking for a wide range of films will have options.”

For the most part, U.S. and U.K. sales agents are banking on thrillers and horror projects to lure buyers. Some of the hottest packages include Lionsgate’s “Now You See Me 3,” with Ruben Fleischer directing and Jesse Eisenberg starring; ”Above the Below,” co-directed by Idris Elba;AGC’s “Eden” (previously titled “Origin of Species”), a thriller starring Vanessa Kirby and Sydney Sweeney; and Black Bearand BlockFilm’s “Levon’s Trade,” starring Jason Statham.

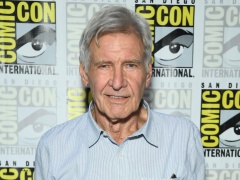

Black Bear also has “She Rides Shotgun,” starring Taron Egerton;FilmNation is selling “The Process,” with Halle Berry, and “Novocaine” with Jack Quaid;HanWay has “Walk With Me,” a psychological thriller, starring Emily Carey, Claes Bang and Suki Waterhouse; and Joseph Gordon-Levitt leads “Greedy People,” from Mister Smith Entertainment. Horror feature “Rabbit Trap,” headed by Dev Patel and Rosy McEwen, is repped by Bankside and CAA Media Finance.

Except a few titles like “Rabbit Trap,” which has wrapped, most projects are expected to roll in the first half 2024 with interim SAG-AFTRA waivers or they will be filming abroad.

Among several high-profile animated projects are Gaumont’s Paul McCartney feature “High in the Clouds,” and “Night of the Zoopocalypse,” from Charades/Anton.

Over at Anonymous Content, Nick Shumaker is bringing a few documentaries to the market, such as Penny Lane’s “Mrs. America,” and the feature “House of Stairs,” which will shoot at the end of the year.

That said, AGC Studios’ Stuart Ford expects the AFM to be “low key” with “only two or three packages of real substance.”

“Even on projects that have talent attached, buyers will be asking: Does the film have a waiver? How certain is it to go forward into production and when? Alas, this AFM is where the waves of uncertainty from the strikes wash over the independent marketplace,” Ford said.

Indeed, even some titles with waivers might not bow in Santa Monica, said Arclight Films’ Brian Beckmann, who said he had hoped the SAG-AFTRA strike would be over by the start of the market.

“A lot of the talent is really being very cautious. They don’t want to appear to be going over the picket lines even if the guilds have given waivers,” Beckmann said. He adds that the company has a couple of projects in pre-production and “moving things forward.”

He pointed out Arclight is able to pull through because the company’s “got a lot of production underway under global rules and in foreign countries,” such as Australia and New Zealand. The company will be at the AFM with films launched at Cannes and Toronto, including “Miranda’s Victim,”“Arthur’sWhisky” and “What Remains of Us,” starring Kit Harington. These are in post and getting ready for delivery, Beckmann said.

Shumaker said most of the narrative movies he has about to enter into production are all non U.S.-films, but they still have to navigate some strike challenges. “If you’ve got foreign actors who are both SAG and Equity or SAG and part of the Canadian union, it’s largely up to their agent and attorney to see if the films need to essentially go under a SAG agreement or whether or not you just go under the local jurisdiction,” Shumaker said.

Another concern for industry players is the state of the U.S. theatrical market which Beckmann describes as sluggish.

“It’s certainly been affected by the strike. There’s been a lot of studios and productions that have basically shut down,” Beckmann said. He predicted a “real content glut in the market and a somewhat artificial bubble” with demand popping back up following the strike. The North American market is seeing a “correction happening because of the big streamers, who have been in a very different mode over the last 18 months or so.” North American distributors who are still in the game, meanwhile, are “really taking an active approach to theatrical releases.”

Leiner said SPC is still in the market to “pre-buy and partner at the script stage.”

“More than ever, the theatrical environment calls for bespoke theatrical release strategies which is why every one of our recent releases looks so different,” Leiner noted, citing “It Ain’t Over,” “Miracle Club” and “Carlos” as examples.

Shumaker has also observed that buyers are more focused on boarding films early.

“You’re seeing that across the independent spectrum, from Neon to A24, whose development slate has been robust for quite some time, to Bleecker Street and Sony Pictures Classics, because they’ve always come in early on certain titles.” The exec said it will be interesting to see how Sundance and Berlin play out for finished films without distribution.

Yet, Ford argued that U.S. distributors’ “buying power and also their confidence in opening movies theatrically is genuinely constrained.”

“If the genre and cast are angled more towards streaming than theatrical in the U.S., the likelihood is that that’s going to be the most receptive audience for the film internationally too. One begets another,” Ford said.

“Buyers are naturally more risk-averse than they used to be because they don’t have the safety net of the guaranteedancillary revenues that they had in the past,” observed David Garrett of Mister Smith Entertainment. He said the surge of horror projects at the AFM is explained perhaps by the fact that “horror doesn’t need name actors.”

But Shumaker said U.S. indies are looking for ways to “operate in the new ecosystem” where both streamers and theatrical distributors have become pickier. “Everybody is trying to understand how you cast an independent movie, how budget them and how you exploit the film for sales and streamers,” said Shumaker, adding that he “(doesn’t) see streamers buying actively.”

“Netflix bought “Hitman” but Richard linklater has a proven quantity and Apple is very selective,” said the executive, who previously worked at UTA and Memento International in France.

International distributors are also being cautious with acquisitions of projects or finished films. “It’s very difficult in this environment to get cast attached to a project,” said Constantin Film’s Martin Moszkowicz. The industry faces “a perfect storm of issues,” most of which aren’t going away soon.

“We still have huge inflation affecting production cost and P&A. Interest costs are high in most countries. Markets have pretty much disappeared, like China or Russia. We have an ongoing strike of the world’s most major actors union,” said Moszkowicz.

While the theatrical box office in Europe hasn’t recovered quicker than in the U.S., Moszkowicz said the German B.O. is “still 20% below pre-COVID levels.” He also pointed out the “spending reduction for the streamers, as much as for television.”

Rob Carney and Alice Laffille at FilmNation said their company has been working on more commercial films over the last few years, for instance “The Crow” reboot and “Lord of War 2.” FilmNation also decided to build an in-house production department and launch the Infrared label to ramp up a pipeline of bigger and more ambitious movies.

Carney said there’s “certainly an appetite for and an excitement for projects that are that are based on prior IP,” such as the reboot of “The Crow.”

One of the heartening aspects of this AFM is the presence of Chinese distributors, who have been absent since the start of the pandemic. “Asia has still been really set back by the pandemic but we’re seeing Chinese distributors who are looking for theatrical releases, not just for TV buys and that’s a big change,” said Beckmann. He predicted “it’s going to be the catalyst to open up Asia.”

Carney added that Japanese and Korean buyers will also be at the AFM, even if Korea is “having a tough time with their box office.”

The AFM, which has new headquarters at the Meridien Delfina Hotel, is expected to welcome more than 245 companies, with China,France,Germany, Italy, Japan, Thailand and the U.K. boasting national pavilions.

(Pictured: “Rabbit Trap”)