For the past decade, Disney has been the Teflon movie studio, remarkably adept at withstanding the tectonic changes impacting the film industry, and well fortified by its arsenal of key properties such as Marvel, Lucasfilm and Pixar.

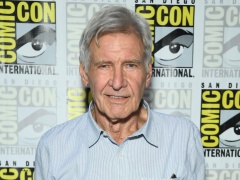

But this year, the long-reigning titan of the box office has shown cracks as four of its biggest releases from those brands and others have struggled in theaters. There was the dispiriting release of “Ant-Man and the Wasp: Quantumania,” a rare Marvel movie to likely lose tens of millions in its theatrical run; “The Little Mermaid,” a remake of the 1989 animated classic that fell drastically short of expectations; “Elemental,” an original story that tried and failed to recapture Pixar’s magic; and most recently “Indiana Jones and the Dial of Destiny,” a nearly $300 million investment in one of cinemas’ most venerable franchises, which no longer appears to have the same hold on today’s audiences. On paper, these films seemed like they had all of the makings of huge hits, but somehow the Disney sparkle was lacking this time, in terms of filling movie theater seats.

Barring a miracle –- or a sudden surge of interest in all things “Haunted Mansion” — “Guardians of the Galaxy Vol. 3” looks like it’ll be the studio’s biggest earner of the year with $835 million. It’s the first time since 2014 (except for the pandemic-stricken years of 2020 and 2021) that Disney won’t have a movie that reaches $1 billion. It also marks a shift from 2022, which saw the studio release not only hits like “Black Panther: Wakanda Forever” and “Doctor Strange in the Multiverse of Madness,” but also “Avatar: The Way of Water,” the third-highest grossing film in history.

Even if that’s the case, Disney still far outranks the competition in terms of market share in 2023, commanding 37% of the industry’s revenues (Universal is close behind at 31%). But ticket sales for the films it has produced have been more Earth-bound, especially compared to the last pre-COVID year, when Disney fielded a record seven movies that crossed the billion-dollar mark in 2019. In many cases, reviews for recent releases haven’t been standout, with critics being particularly scathing about “Quantumania” and openly questioning the need for a fifth “Indy” adventure. Audiences have been kinder, giving these movies respectable ratings on Rotten Tomatoes and CinemaScore.

There are other issues bedeviling the Magic Kingdom these days. Because of its all-tentpole, all-the-time strategy, Disney’s movies each require production budgets of at least $200 million — plus marketing costs of roughly $100 million. That means the studio’s films have a higher benchmark than its rivals to break even at the box office. In the past, those budgets were justified with movies that crossed $1 billion worldwide with ease. Those price tags are riskier in today’s box office landscape, with China’s dollars no longer a guarantee due to tensions with the West and changing tastes. Russia, another major market, is entirely cut off from Hollywood movies after its invasion of Ukraine. As a result, the international box office has diminished to a shadow of its former self, and that has major consequences for Disney’s profitability. To be fair, every studio is grappling with these punishing realities as the box office remains down roughly 20% from pre-pandemic times, but Disney has historically enjoyed such a track record of success and its issues are casting a pall over the movie business.

“Anything Disney threw out in 2019 made $1 billion,” says Jeff Bock, an analyst with Exhibitor Relations. “Now, it’s more difficult than ever to release a film worldwide. The international landscape has changed. It’s not close to back.”

The problem is that getting these costs under control will take time. Major movies take at least three to four years to develop, produce and distribute — a lifetime in a fast-changing industry. Even if Disney is serious about tightening its belt, it may not make a noticeable difference until 2026 or beyond.

“It takes a long time for a big ship like Disney to change course,” says Paul Verna, principal analyst at Insider Intelligence.

Some of these bloated budgets on 2023 releases reflect the tens of millions that were racked up from pandemic delays and enhanced COVID testing. That should ease as the pandemic becomes a less disruptive force, which should be a key source of cost savings. Beyond that, there are questions about where else Disney may save money — will it be in marketing the movies it produces or in cutting back on special effects and other cinematic set-pieces?

“If you cut costs, do you degrade the quality of the product?” says Brandon Nispel, an equity research analyst with KeyBanc Capital Markets. “If you spend less, do people like the movies you are making less? And how much and how fast can you start cutting?”

The turn in fortunes isn’t only due to market conditions, but also a mix of creative shortfalls and outsized attention on streaming. Disney’s banner year in 2019, with the releases of “Avengers: Endgame,” “The Lion King,” “Frozen II” and more, came before Disney+ launched and squashed the need for repeat viewings in theaters. With “Endgame,” for example, people went to the movies three, four, even five times to watch the epic blockbuster that bid adieu to some of Marvel’s biggest heroes. Now, there’s less of a need to make multiple trips to the multiplex. Moviegoers can wait a matter of months (or less) for a film to land on streaming and satisfy the need for a rewatch.

“People have become conditioned to expect that things will quickly appear on Disney+,” says Neil Macker, a senior equityanalystfor Morningstar Research Services. “The theatrical movie business has been in decline for awhile and the pandemic accelerated that.”

Pixar has suffered the most from that mindset, analysts believe. The animation empire has been struggling since the onset of COVID, when several of its titles were sent directly to Disney+ and trained family audiences to watch its movies at home. It’s re-entering the theatrical ring with heightened competition in the animation space from Illumination (“The Super Mario Bros. Movie,” “Minions: The Rise of Gru”), DreamWorks (“Puss in Boots: The Last Wish”) and Sony Pictures Animation (“Spider-Man: Across the Spider-Verse”). And those companies spend a fraction of Pixar’s budget to bring its animated adventures to life. Universal’s “The Super Mario Bros. Movie,” which is expected to be the year’s highest-grossing film with more than $1.3 billion in revenues, cost $100 million to bring to life. That’s roughly half of what Pixar shelled out for “Elemental,” which has yet to crack $200 million globally. Rival studios believe that Disney’s animated efforts have become too twee and lack the more populist edge of “Mario” or Paramount’s upcoming “Teenage Mutant Ninja Turtles” reboot.

“Pixar is becoming an anemic brand,” notes Verna. “It’s fallen so far from the days in in which anything it released would blow the doors off.”

“Star Wars,” too, has lost its luster in theaters as the franchise set in a galaxy far, far away has found repeated success on Disney+ with series like “The Mandalorian” and “Andor.” But following the 2019 release of “The Rise of Skywalker,” Lucasfilm’s efforts to get another trilogy off the ground have proceeded in fits and starts, with several high-profile projects being announced only to disappear into development limbo. Disney has planted three “Star Wars” films on the release calendar in 2026 and 2027, but hasn’t revealed any details about those movies.

“I’ll believe there’s a new ‘Star Wars’ movie when I’m seated in the theater and seeing the opening crawl,” says Josh Spiegel, a freelance film critic who specializes in Disney. “There have been so many false starts.”

As a sprawling media conglomerate, Disney is facing issues on all fronts. Bob Iger, who returned as CEO after a brief hiatus and displaced his successor Bob Chapek, is simultaneously battling Wall Street’s unrest over the unprofitability of Disney+, concerns that Disney’s parks business may have alienated customers with its higher prices, and a rise in cord cutting that’s imperiling its cable properties like ESPN. These are all doing more to depress Disney’s share price (which is down nearly 7% year-over-year) than the struggles with its latest movies.

“Streaming was positioned as the greatest business ever, and it didn’t live up to the hype,” says Nispel. “Disney’s losing more money than people thought it would, and the market became saturated more quickly than people expected. At the same time, the ground is shifting under linear TV and the parks business that had been a cash cow hasn’t fully recovered from the pandemic. Those are far bigger problems.”

And yet, Disney’s film business has long been an important stabilizing force, with the studio dwarfing the competition. And there’s been a very successful formula that Disney has deployed — not so much leaning into nostalgia as diving in head first — which may no longer be as effective. Live-action remakes of classics such as “Aladdin,” “Beauty and the Beast” and “The Jungle Book” were theatrical goldmines, even as those films were criticized by some as shot-for-shot remakes of the originals. At that time, the Disney name alone was enough to cut the noise in a crowded market. But the lackluster global turnout for “The Little Mermaid” is a sign that brand familiarity is no longer the ticket to get people to go to theaters. And the failure of the latest “Ant-Man” indicates the studio may need to be more judicious in the sequels it decides to back. That’s an issue because the studio has found less success in launching new original franchises, other than “Frozen.”

“Disney desperately needs to create something new,” Spiegel says. “It does a good job at cannibalizing itself. They remake their movies and echo what they’ve done in the past. At a certain point, there won’t be a whole lot for them to echo.”

More than its competitors, Disney can withstand some of its movies functioning as loss leaders. In addition to racking up ticket sales, the studio’s films are designed to boost interest in toys and theme parks. So although “The Little Mermaid” barely floated past the $500 million mark, the return of Ariel is helping to sell themed Legos, backpacks, dolls, bedding and nail polish. The same goes for underperforming Marvel adventures like “Ant-Man,” which brings an influx of interest to Avengers Campus, a Marvel Cinematic Universe–themed area at the Disney California Adventure park.

“They may not make it at the box office, but Disney will make up for it in merchandise sales and the longevity of the property,” says Bock. “That’s a lot different than Paramount or Sony, who needs to make all their money back at the box office.”